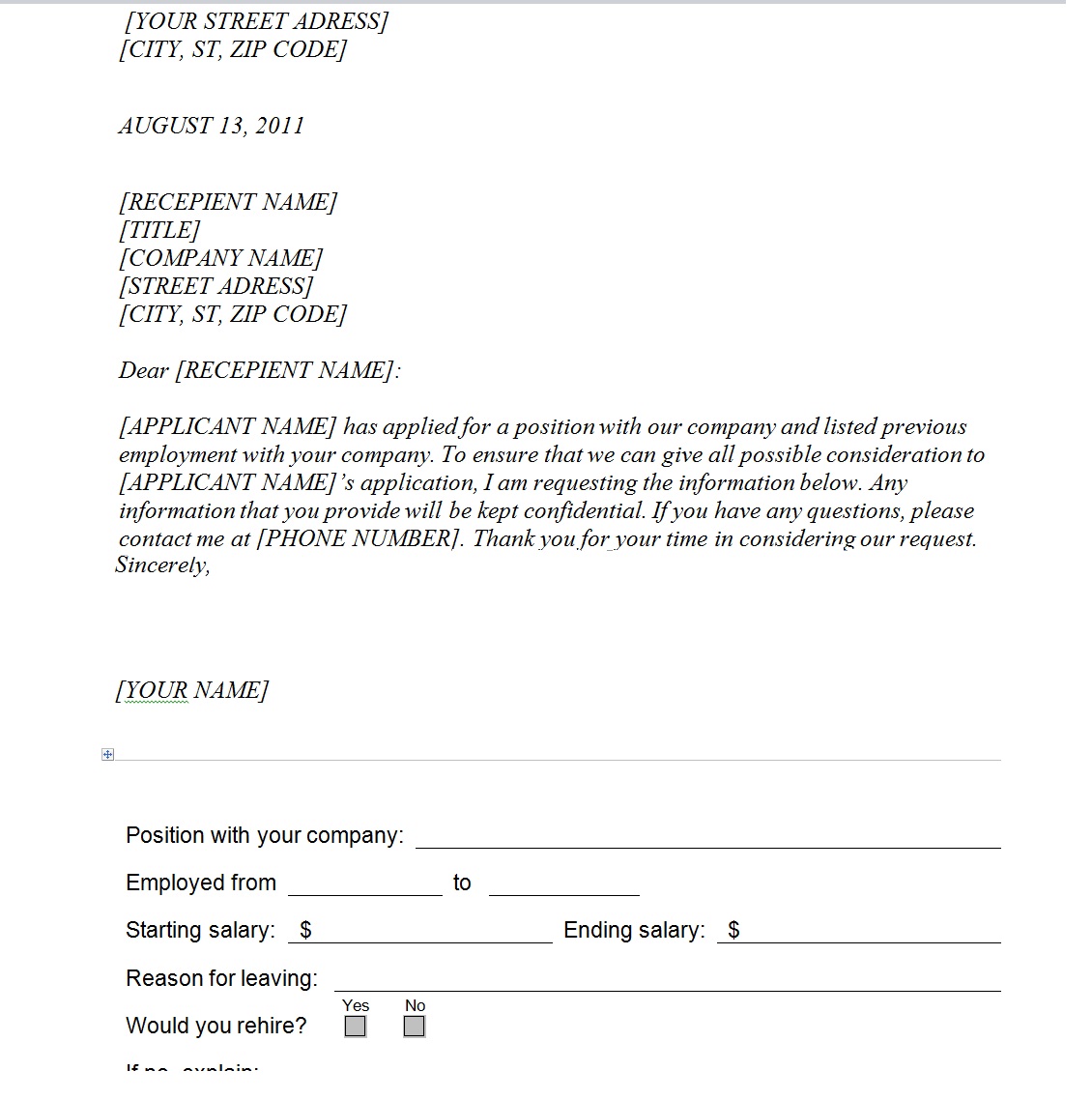

“They ask for verification of salary and continued employment and any other information that might be relevant.” “Typically, the employee will sign a release, and the bank will send the information to the company to verify,” said Lucas. Lucas explains that it’s simply not enough for someone to state that they have a job when obtaining a loan or something similar and that the bank will want to verify employment. “For example, a document might list the dates of employment, that person’s title, and sometimes, that company may be willing to share if the employee is rehireable or re-eligible for work.” What Is Included in an Employee Verification Letter? “Generally, most companies stick to the facts with employee verification letters,” said Johnston. Johnston explains that the reason to first go to HR is because most companies have policies about divulging information on current or past employees. Once the appropriate stakeholders have filled it out, the company will send your employee verification letter to the requesting party or ask you to send it. The HR personnel will have a templated letter that the manager or supervisor will fill out or they may request you produce a template. The company you work at or previously worked for may require you to sign a release form that grants permission to disclose employment information and history to a third party. If, however, you do find yourself needing to request an employee verification letter yourself, the best place to start is to first contact the human resources (HR) department to request the document. Another way is for your future employer to directly contact your former employers in order to fulfill the employment verification.” The company could use that background check to get employment verification, your criminal history and sometimes your credit. “The company could extend you an offer dependent on a background check, which means there’s a verbal offer that hinges on the results from that report. “Typically, a verification letter can be done in a couple of ways,” said Sarah Johnston, executive resume writer, interview coach and career coach and speaker. Requesting an Employee Verification Letter

Whether you are trying to obtain a new line of credit or settle into a new residence, you’ll want to be prepared for the process. However, most employers are unlikely to volunteer information such as salary.” “As part of a background check, the new company may contact your previous employers to verify dates of employment. “A company may verify previous employment, but it’s not generally a formal letter,” said Lucas. Suzanne Lucas, expert resume writer, career coach and keynote speaker, further clarifies that primarily, employment verification letters are for processes such as obtaining loans. “People might need this verification for future employment, but particularly when applying for a line of credit, or filling out mortgage and rent applications.”

EMPLOYMENT VERIFICATION LETTER PROFESSIONAL

“The employment verification is to confirm someone's current and former employment status,” said Yvonne Robinson-Jackson, leadership coach, professional branding expert and career growth coach. Financial institutions, government agencies, landlords, mortgage lenders and potential employers may ask for an employment verification letter. There may be several times you’ll be requested to show an employee verification letter. Mortgage lenders, new employers and government agencies often request employee verification letters.Īn employee verification letter is a document that shows proof of a person’s current employment or previous employment at a company. These letters provide an employee’s salary, proof they worked at a specific company, as well as dates of employment. Employee verification letters verify their statement of employment is true.

0 kommentar(er)

0 kommentar(er)